Table of Contents Show

I. Introduction

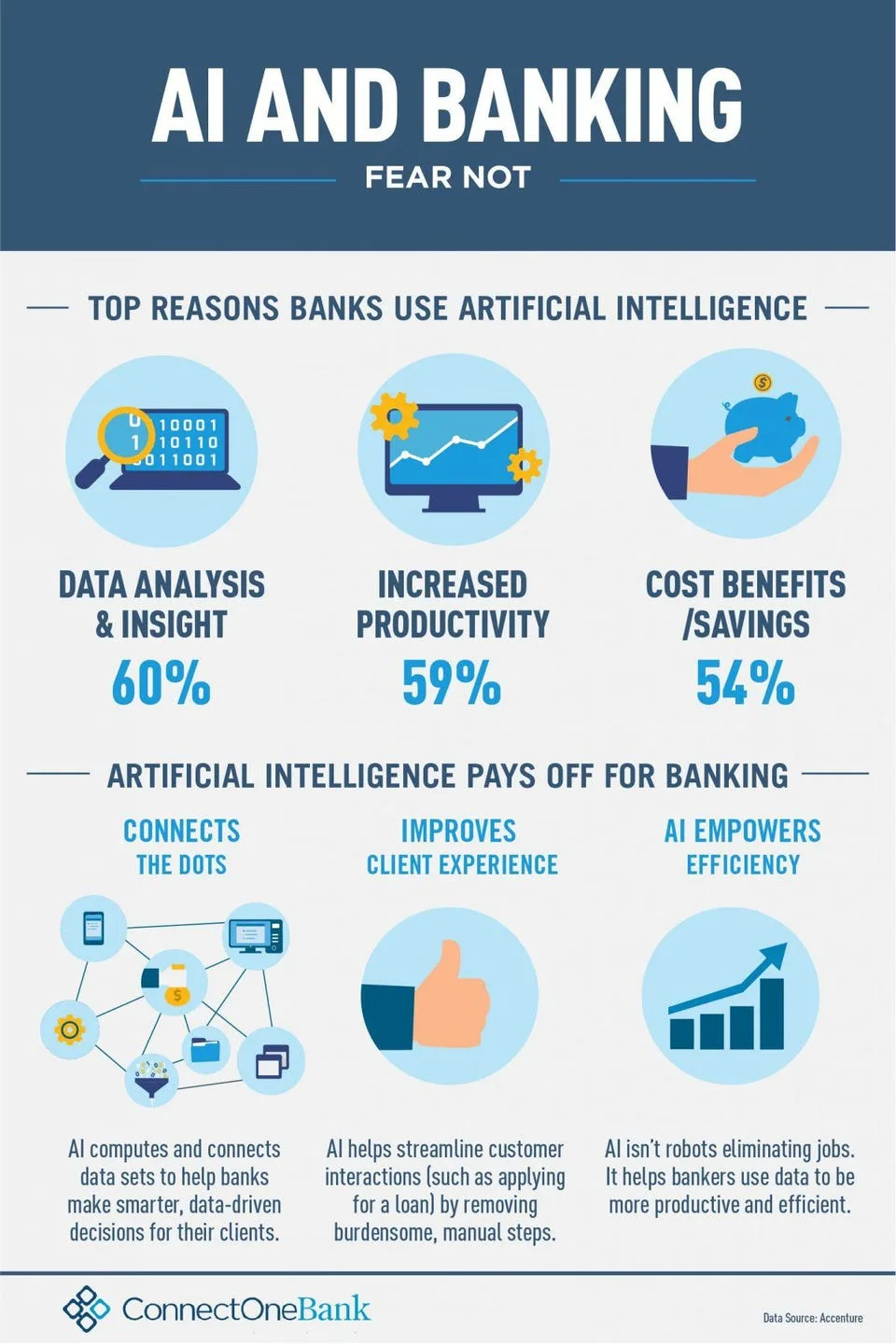

Artificial intelligence (AI) has recently changed many industries by automating procedures, streamlining operations, and generating insightful information from enormous amounts of data. AI is becoming a crucial tool for businesses looking to stay competitive in the digital age, from manufacturing to healthcare. But how to use AI in banking and finance? How AI can help the Banking industry?

The potential of AI in banking and finance

The growing impact of AI is common to the banking and finance industries. Financial institutions increasingly use AI solutions to improve services, cut costs, and provide tailored customer experiences. Banks can improve decision-making, streamline processes, and ultimately increase customer satisfaction by utilizing AI.

Artificial intelligence is everywhere, from cryptocurrency to Energy to Space, because of its numerous benefits. This article will examine the application of AI in banking, highlight key areas where it can be used, and offer a step-by-step manual for implementing AI solutions into banking operations for increased productivity and client satisfaction.

II. Understanding the Role of AI in Banking and Finance

A. Improved efficiency in banking operations

AI enhances banking operations’ efficiency by automating routine tasks, increasing speed and accuracy in decision-making, and eliminating human error. Regulatory compliance, customer onboarding, and loan processing are just some of the processes that can be automated. Banks can free up workers and money by automating these routine tasks, allowing them to put those resources toward more critical endeavors.

B. Enhanced customer satisfaction and personalization

Banking institutions can now provide customers with individualized support and specialized financial services thanks to AI. Using sophisticated data analytics and machine learning algorithms, AI tools can determine consumer tastes, anticipate their requirements, and provide tailored suggestions. This aids financial institutions in providing a more exciting and fulfilling service to their clients, increasing customer loyalty and retention.

C. Key areas where AI can be implemented

There are several areas within banking where AI can be implemented to drive improvements in efficiency and customer satisfaction:

- Customer service: AI-powered chatbots can handle many customer inquiries, providing instant support and reducing wait times.

- Fraud detection and risk management: Machine learning algorithms can analyze large datasets to identify patterns and anomalies, helping banks detect and prevent fraudulent activities.

- Credit scoring and loan approval: AI can evaluate creditworthiness more accurately by analyzing various data points, leading to faster loan processing and improved risk assessment.

- Portfolio management and financial advisory: AI-driven tools can analyze market trends and provide personalized investment advice to customers based on their financial goals and risk appetite.

- Operational efficiency: AI can streamline various back-office processes, such as compliance and data management, by automating manual tasks and improving data accuracy.

III. Steps to Implement AI Solutions in Banking

A.Identifying the right use cases and areas of improvement

Before implementing AI solutions, banks must identify areas where AI technologies can be beneficial. This entails analyzing current processes, identifying inefficiencies, and determining the most impactful AI use cases. Banks can maximize the return on their AI investment by focusing on areas with the most significant potential for improvement.

B. Selecting the appropriate AI technologies and tools

Once the target areas have been identified, banks must choose the AI technologies and tools that best align with their goals. Machine learning algorithms, natural language processing, computer vision, or combining these technologies may be used. It is critical to select scalable, adaptable, and compatible tools and platforms with the bank’s existing infrastructure.

C. Building or partnering with AI development teams

AI solution implementation necessitates specialized knowledge and expertise in AI development. Banks can build in-house AI development teams or collaborate with external AI service providers. When selecting a partner, banks should consider factors such as experience, domain expertise, and the ability to deliver tailored solutions that meet their specific needs.

D. Integrating AI solutions into existing banking infrastructure

AI solution implementation requires seamless integration with the bank’s infrastructure and systems. This is part of connecting AI tools to databases, customer relationship management (CRM) systems, and other relevant platforms. Banks should also plan for any infrastructure upgrades that are required, as well as allocate resources for ongoing maintenance and support.

E. Ensuring data privacy and security

As we know, Ai can help us with implementing security measures. Data privacy and security are critical concerns for banks implementing AI solutions. Banks must ensure that their AI tools adhere to all applicable data protection regulations and maintain the highest levels of security. Implementing robust data encryption, access controls, and continuous monitoring to detect and prevent potential security breaches is part of this. Furthermore, banks should establish clear policies and guidelines for the ethical use of AI to reduce the risk of bias and discrimination in AI-driven decision-making.

IV. AI Applications in Banking for Enhanced Efficiency

AI-powered chatbots for customer support

Chatbots powered by artificial intelligence can quickly answer questions about account balances and transaction histories. Automating mundane customer service tasks allows banks to respond to customers more quickly and accurately, increasing their satisfaction.

Automated loan processing and credit scoring

More comprehensive data, such as a customer’s credit history, income, and spending habits, can be analyzed by AI algorithms to determine creditworthiness. This allows financial institutions to improve efficiency, decrease the possibility of mistakes, and broaden their range of individualized loan options and rates.

Fraud detection and risk management

The risk of financial loss for banks and their customers can be significantly reduced thanks to artificial intelligence systems that detect unusual transaction patterns and potential flag fraud in real-time. Further, by forecasting market trends and assessing potential risks, AI-driven risk management tools can assist banks in making more prudent lending and investment decisions.

AI-driven portfolio management and financial advisory

Advisors powered by AI can sift through mountains of data to make recommendations tailored to each client’s risk tolerance and long-term financial objectives. This allows financial institutions to provide individualized financial planning services, thereby assisting their clientele in making more educated decisions and realizing their monetary goals.

V. Measuring the Impact of AI Solutions on Customer Satisfaction

A. Tracking customer satisfaction metrics

To assess the impact of AI solutions on customer satisfaction, banks should track key performance indicators (KPIs) such as response time, resolution rate, and customer satisfaction scores. By monitoring these metrics, banks can identify areas for improvement and adjust their AI strategies accordingly.

B. Gathering customer feedback and analyzing user experience

Collecting customer feedback through surveys, reviews, and social media can provide valuable insights into the effectiveness of AI solutions and their impact on customer satisfaction. By analyzing this feedback, banks can identify potential issues and make necessary adjustments to enhance the user experience. Currently, there are many GPT-powered AI tools helping in this matter.

C. Adapting AI solutions based on feedback and performance

Continuously monitoring the performance of AI solutions and incorporating customer feedback is essential for ensuring ongoing improvement and customer satisfaction. By regularly updating and fine-tuning AI algorithms and systems, banks can stay ahead of evolving customer needs and expectations, maintaining a competitive edge in the market.

VI. The Future of AI in Banking and Finance

Emerging trends and technologies in AI and banking

As technology develops, the banking and financial industries are seeing new developments and uses of AI. Some examples are the advancement of AI-driven financial products and services, using NLP to better engage with customers, and combining AI and blockchain technology to ensure the safety of financial transactions.

The Role of artificial intelligence in Shaping the financial markets

Better predictions, streamlined trading processes, and more effective risk management are just a few ways AI is expected to increase its substantial impact on the financial markets. Financial institutions are increasingly turning to artificial intelligence to stay ahead of the competition and successfully navigate the world’s complex economic landscape.

The potential for AI-driven banking innovation

If financial institutions (mainly banks) keep investing in AI, they will be in a prime position to lead the way in industry disruption. Artificial intelligence (AI) has the potential to completely transform the banking industry, from the way banks operate internally to how they interact with customers.

VII. Conclusion

The transformative potential of AI in banking

The use of AI in banking and finance industry is inevitable. Artificial intelligence has the potential to transform the banking industry by increasing efficiency, lowering operational costs, and improving customer satisfaction. By implementing AI solutions, banks can streamline their operations, make more informed decisions, and provide more personalized services to their customers.

Implementing AI solutions is critical for banks seeking to remain competitive in an ever-changing financial landscape. Banks can improve operational efficiency and significantly improve the overall customer experience by leveraging AI technology. Knowing the benefits of AI, this tech is worth investing in.

Artificial intelligence technologies To successfully implement AI in banking, a strategic approach is required, which includes identifying the appropriate use cases, selecting appropriate technologies and tools, building or partnering with skilled AI development teams, and integrating AI solutions into existing infrastructure. By taking these steps, banks can fully realize the potential of AI and drive meaningful industry innovation.

FAQs

The future of AI in banking is expected to bring more advanced applications, greater personalization, and improved efficiency. AI will continue to revolutionize banking operations, enhance customer experiences, and help financial institutions navigate the complexities of the global economic landscape.

AI can be used in banking for a variety of purposes, including fraud detection, credit scoring, customer support through chatbots, risk management, automated loan processing, portfolio management, and personalized financial advisory services.

Artificial intelligence impacts the banking industry by streamlining processes, lowering operational costs, increasing customer satisfaction, and enabling more accurate predictions and decision-making. AI is also propelling financial product and service innovation.

The benefits of AI banking include improved efficiency, reduced operational costs, enhanced customer experiences, more accurate risk assessments, better fraud detection, and the development of innovative financial products and services tailored to individual customer needs.

AI plays a significant role in finance by enabling more efficient processes, providing accurate predictions and decision-making, and enhancing risk management. AI is also crucial in the development of new financial products and services, as well as in the automation of various financial tasks.

AI is the financial industry’s future because it can transform it by increasing efficiency, lowering costs, and enabling more personalized and innovative financial services. AI-powered solutions can assist financial institutions in remaining competitive and navigating the complexities of the global economic landscape.

Artificial intelligence (AI) transforms the financial sector by automating repetitive tasks, streamlining processes, and offering more precise predictions and insights. This technology enables financial institutions to make better-informed decisions, manage risks more effectively, and provide personalized financial services tailored to individual customer needs.

Do you want to read more? Check out these articles.

3 comments