I. Introduction

Machines that mimic human intelligence in ways that allow them to perceive, reason, learn, and make decisions are said to have artificial intelligence (AI). Machine learning, natural language processing (NLP), Computer Vision (CV), and robotics are all examples of artificial intelligence technologies. Potential AI advantages include faster processing times, higher precision, and better judgment. There are tons of opportunities, but why and how to invest in AI?

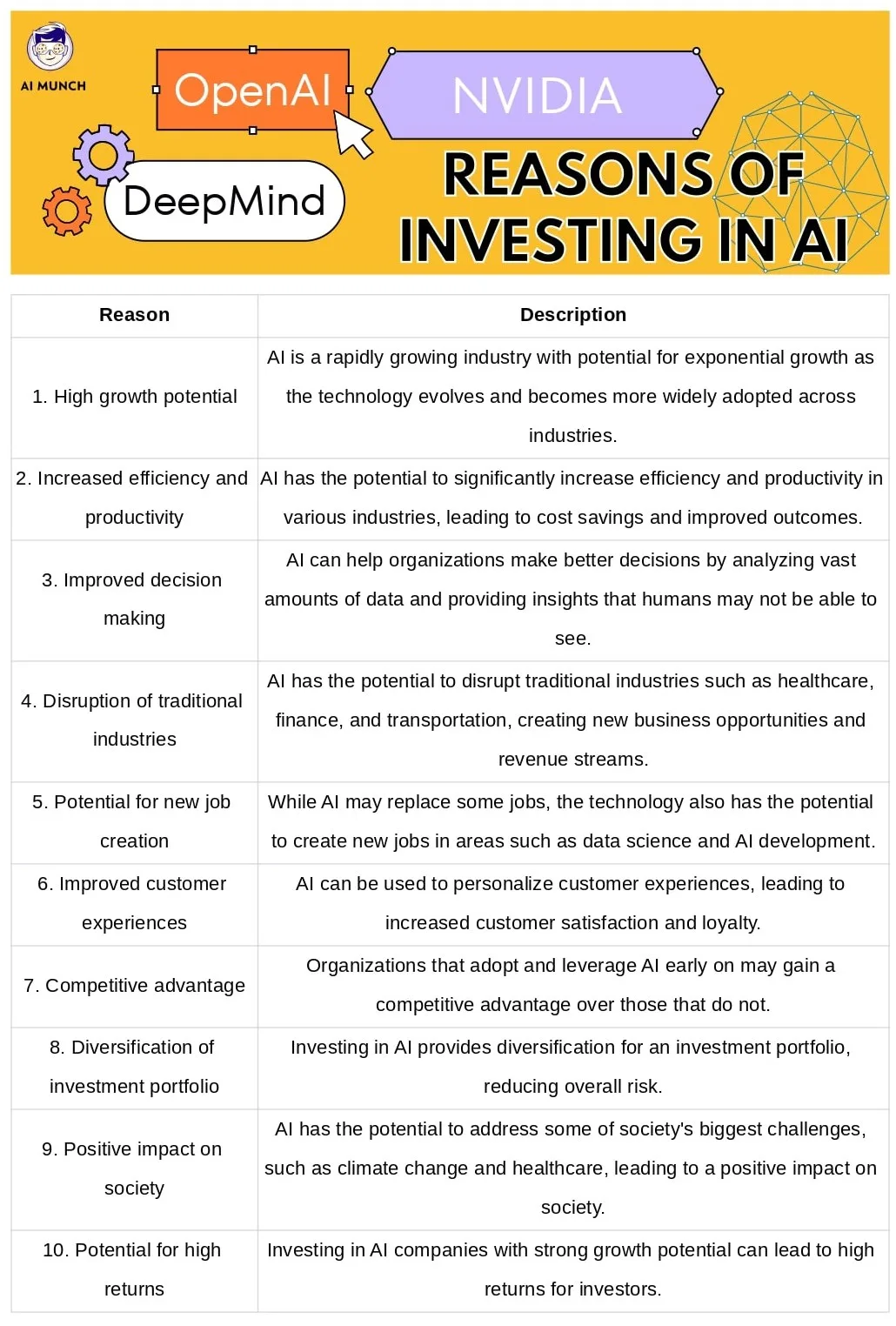

Why invest in Artificial Intelligence (AI)

Artificial intelligence (AI) is a cutting-edge technology that has the potential to change the game in many fields, from medicine to finance. Since the launch of OpenAI ChatGPT, artificial intelligence has been getting more and more attention. ResearchandMarkets estimates place the AI market at over $21000 Million by 2030, expected to overgrow over the next few years. It is possible to reap the rewards of this expansion and make sizable returns by investing in AI. Putting money into AI research and development can also speed up the arrival of game-changing improvements that will help everyone in the long run.

II. Understanding Artificial Intelligence Investment

A. Different types of AI investment

Direct investment in AI companies, AI-focused funds, and AI-related stocks are all examples of how to put money toward the development of artificial intelligence. To invest directly in AI companies, you must buy stock in companies that use Artificial intelligence systems. Funds that put most of their money into artificial intelligence companies are called “AI-focused funds.” Stocks in companies that supply AI components or that use AI to improve their products and services are what investors mean when they talk about “AI stocks.”

B. Risks associated with AI investment

There are several dark sides of AI. Investing in AI carries risks, just like any other investment. Since AI is still in its infancy, there is no assurance that the technology will develop to its full potential or that AI businesses will thrive. In addition, there is intense competition in the AI market, increasing the risk that companies will fall behind the curve. There are also ethical and regulatory concerns that could slow down the development of AI and discourage investors from putting money into AI businesses.

C. Potential returns on AI investment

The AI industry is projected to expand rapidly over the next few years, making it an attractive investment opportunity. Businesses can save money, and AI developers may be able to make more money thanks to AI’s potential advantages, such as increased efficiency and improved accuracy. Further, venture capitalists and other investors may pour money into the AI sector, which could boost company valuations and returns. Yet, before putting money into artificial intelligence, investors should weigh the risks against the potential rewards.

III. Steps to Invest in Artificial Intelligence (AI)

Time needed: 5 days

Making educated AI investment decisions calls for extensive study and investigation. If you want to invest in artificial intelligence, here are the first six things you should do:

- Determine investment goals

If you know the answer to this step, you will easily tackle the question, “How to invest in Artificial intelligence (AI)”. Identifying your investment objectives is crucial before putting money into AI. Do you want steady development over time or quick profits now? Do you want to achieve a certain amount of money? Identifying and understanding your investment objectives is crucial in choosing an investment strategy and measuring its success.

- Research AI companies

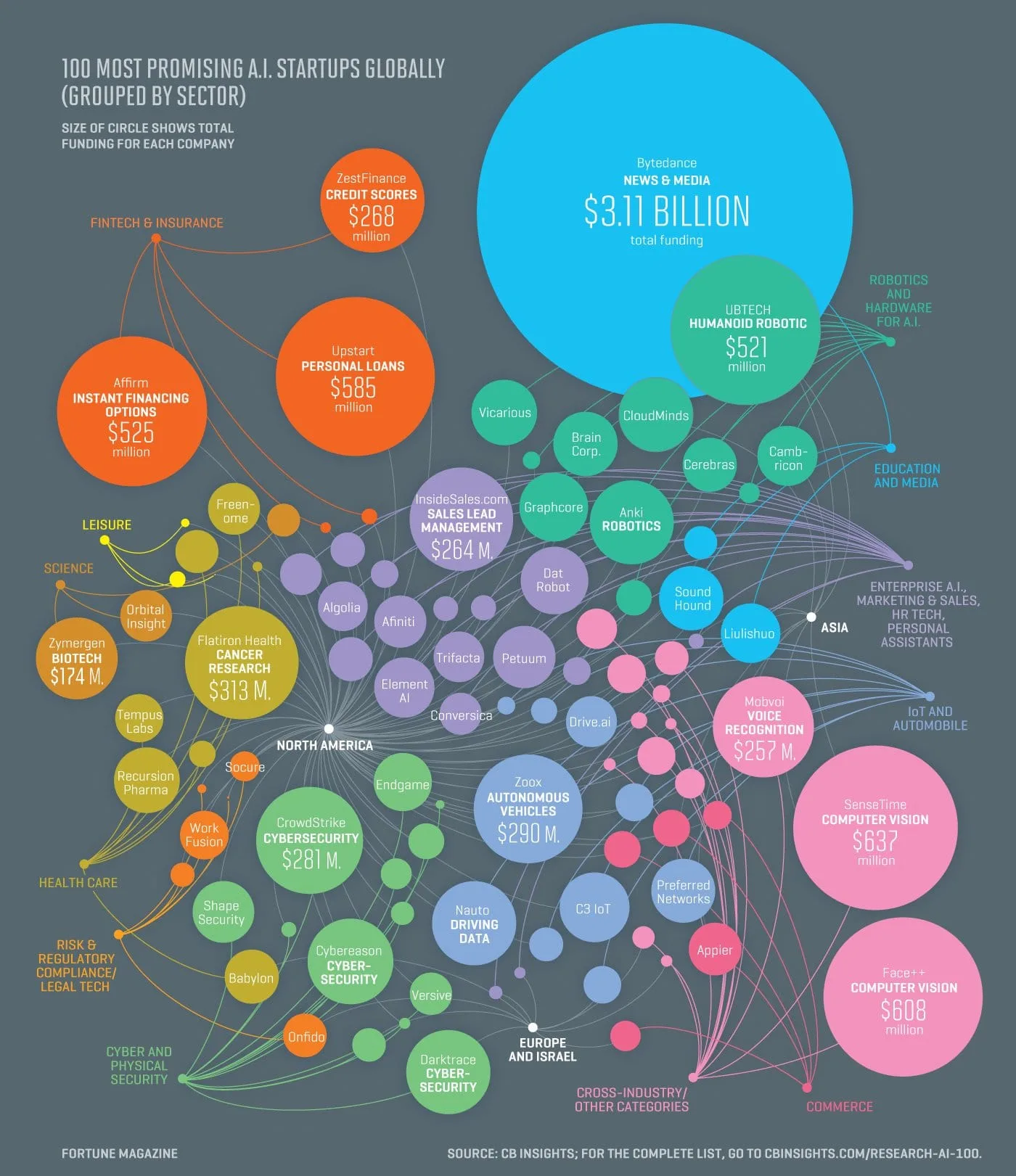

Potential investors should investigate AI-related businesses. This means learning how the company works, who its target market is, and what its competitors are like. Examining the company’s management team to learn about their background and success would be best. (Image Source: Fortune)

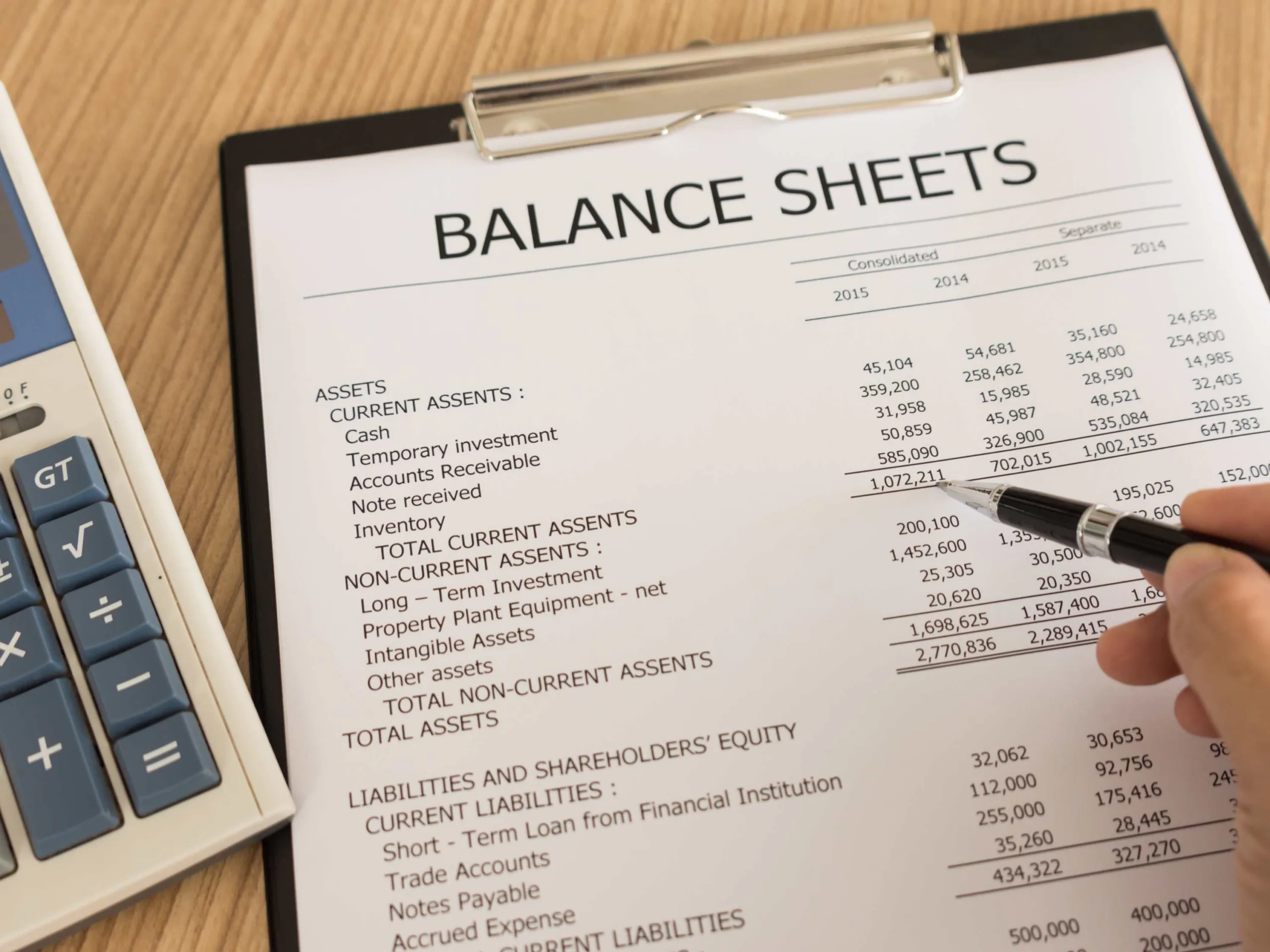

- Analyze financial statements

Financial statements are an essential part of due diligence for any company, and AI companies are no different. The company’s revenue, profitability, and cash flow must be analyzed. A company’s balance sheet can tell investors a lot about its financial strength and debt.

- Consider macroeconomic trends

When making AI investments, capitalists should think about the economy as a whole. One thing to consider is how economic cycles, government rules, and technological changes affect the AI sector. Investors should also consider the potential impact of geopolitical events on the business sector.

- Determine risk tolerance

Riks does exists when you think to invest in AI. There is uncertainty when investing in AI; you should weigh the potential rewards against those dangers. You should know how much you can afford to lose in the stock market and how much risk you will take.

- Diversify investment portfolio

Investors should spread their money around by putting money into various artificial intelligence companies, exchange-traded funds (ETFs), mutual funds, and other financial instruments. This helps to maximize returns while minimizing the portfolio’s overall risk.

By following these rules, investors will be better able to take advantage of the fast growth of the AI industry.

IV. Alternative Ways to Invest in AI

In addition to AI companies to invest in, directly, there are several alternative ways to invest in Artificial intelligence. Here are four options for investors interested in AI:

A.Investing in ETFs

Several exchange-traded funds (ETFs) focus on artificial intelligence (AI) and related technologies that investors can use to get a piece of the growing AI industry. List of top exchange-traded funds (ETFs) in artificial intelligence:

1.Global X Robotics & Artificial Intelligence ETF (BOTZ)

With over $5 billion in assets under management, the Global X Robotics & Artificial Intelligence ETF is one of the largest and most popular AI ETFs. This exchange-traded fund puts its money into businesses across the industrial, healthcare, and consumer sectors that create or use artificial intelligence and robotics.

2.iShares Robotics and Artificial Intelligence ETF (IRBO)

Another well-known AI ETF is the iShares Robotics and Artificial Intelligence ETF, which manages over $1.3 billion in assets. This exchange-traded fund backs businesses in making, designing, and developing robotics and AI systems across various sectors.

3.First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT)

Companies working on AI and robotics are the primary focus of the First Trust Nasdaq Artificial Intelligence and Robotics ETF. The ETF invests in various sectors, including healthcare, manufacturing, and technology.

4.AI Powered Equity ETF (AIEQ)

One-of-a-kind computer program actively manages the AI Powered Equity ETF. The algorithm picks stocks based on how likely they will beat the market. It analyzes financial data and news articles with machine learning and natural language processing.

5.Invesco QQQ

The Invesco QQQ ETF is not a dedicated AI ETF, but it provides exposure to several large technology firms with significant investments in AI and related fields. The ETF index follows the Nasdaq-100, which includes tech giants like Apple, Amazon, and Alphabet (Google’s parent company).

Investors can get a diversified view of the growing AI industry without picking individual stocks. They can do this through exchange-traded funds (ETFs) focusing on the sector. However, before putting money into any ETF, you should learn as much as possible about its holdings, fees, and investment strategy.

B.Investing in mutual funds

To invest in AI, you should think of its mutual funds as well. Another common strategy is investing in mutual funds that focus on the AI sector. Mutual funds that invest in artificial intelligence and related technologies:

1.T. Rowe Price Global Technology Fund (PRGTX)

The T. Rowe Price Global Technology Fund funds businesses in all technology areas, such as artificial intelligence and robotics. The fund is looking for companies with a competitive advantage and high growth potential over the long term.

2.Fidelity Select Software and IT Services Portfolio (FSCSX)

The Fidelity Select Software and IT Services Portfolio invest in businesses that create software and IT services, including those that focus on artificial intelligence and similar areas. The fund aims to increase its value over time by purchasing shares of companies with a good chance of succeeding in their respective industries.

3.Vanguard Information Technology Index Fund (VITAX)

The Vanguard Information Technology Index Fund, an index fund, can keep track of investments in the technology sector, including artificial intelligence (AI) and related technologies. The fund aims to give investors various low-cost ways to invest in the technology industry.

4.BlackRock Science and Technology Opportunities Portfolio (BGSAX)

The BlackRock Science and Technology Opportunities Portfolio is for people interested in science and technology, like artificial intelligence and related technologies. The fund aims to increase its value over time by purchasing shares of rapidly expanding companies.

5.T. Rowe Price Science and Technology Fund (PRSCX)

T. Rowe Price’s Science and Technology Fund backs companies in the AI and robotics industries. The fund’s goal is long-term capital appreciation, so it prioritizes high-growth, competitive companies.

C. Investing in AI-Focused Hedge Funds

Investing in AI-focused hedge funds is another way for accredited investors to gain exposure to the growing AI industry. Here are some notable AI-focused hedge funds:

1.Bridgewater Associates

Bridgewater Associates is a hedge fund that uses AI and machine learning to analyze data and make investment decisions. The fund has been successful in using AI to identify market trends and generate high returns.

2.Two Sigma Investments

Two Sigma Investments is a quantitative hedge fund that uses AI and machine learning to analyze data and make investment decisions. The fund has been successful in using AI to find new investment opportunities and generate high returns.

3.Renaissance Technologies

Renaissance Technologies is another quantitative hedge fund that uses AI and machine learning to analyze financial data and make investment decisions. The fund has been successful in generating high returns through its use of AI and machine learning.

D. Investing in AI-Related Stocks

Investing in the stocks of companies that work on artificial intelligence and related technologies can be risky, but it can also be an excellent way to make money. Some well-known businesses that could be suitable investments are listed below.

Alphabet Inc. (GOOGLE)

Alphabet, which owns Google, is doing a lot of work in artificial intelligence and machine learning. The Google search algorithm, self-driving car technology, and Google Assistant are all powered by artificial intelligence. Google’s AI has been used to improve software for translation, image recognition, and natural language processing (NLP).

NVIDIA Corporation (NVDA)

NVIDIA is a semiconductor firm that creates graphics processing units (GPUs) for use in artificial intelligence (AI) and machine learning (ML). The company’s GPUs are in various places, including data centers and autonomous vehicles. NVIDIA’s graphics processing units (GPUs) are becoming more critical for developing AI systems because they allow faster processing times and better data analysis.

Amazon.com, Inc. (AMZN)

Artificial intelligence powers Amazon’s Alexa, logistics system, and recommendation engine. The company has also created products with artificial intelligence, such as the Echo smart speaker series. Amazon is also working on self-driving delivery vehicles that use artificial intelligence and machine learning to avoid accidents and get around traffic.

Microsoft Corporation (MSFT)

Microsoft is working on several different artificial intelligence (AI) projects, such as improving natural language processing (NLP), building an AI-powered health chatbot, and adding AI to the company’s productivity software. Businesses can gain access to Microsoft’s cutting-edge AI technology and the many AI tools and services it offers through the company’s cloud computing services.

Tesla, Inc. (TSLA)

AI and machine learning power Tesla’s Autopilot system, enabling autonomous driving. Powering Tesla’s energy storage and solar products are artificial intelligence technology. With its eye on the future of transportation and clean energy, the company has become a popular choice for investors.

How well or poorly a single stock does can significantly affect the value of an investor’s whole portfolio. To lower the chance of losing money, investors should spread out their holdings and do a lot of research on each stock they buy.

V. Conclusion

We can see AI in almost every field, from Finance to energy to education, even in Cryptocurrency. High returns are possible from investing in AI, and doing so can help spur the creation of valuable new technologies. The AI market is poised for explosive growth in the years ahead, making it a promising sector to put money into.

Summary of crucial steps to investing in AI

When investing in artificial intelligence, it’s essential for investors first to establish their investment objectives, conduct company research, examine financial statements, take macroeconomic trends into account, ascertain their level of risk tolerance, and diversify their portfolio.

Artificial intelligence investments require thorough investigation and analysis but may yield high returns. By diversifying their holdings and staying up-to-date on market changes, investors can increase their returns and help create cutting-edge AI solutions.

FAQs

Investing in artificial intelligence (AI) means making money from companies that use AI and similar technologies. If you want to invest in the AI sector, you can choose from ETFs, mutual funds, hedge funds, and individual stocks of AI-related companies.

Investing in artificial intelligence (AI) means making money from companies that use AI and similar technologies. If you want to invest in the AI sector, you can choose from ETFs, mutual funds, hedge funds, and individual stocks of AI-related companies.

AI can change many industries, such as healthcare, finance, and transportation, making it an attractive investment opportunity. But companies could make a lot of money if they can meet consumer demand for artificial intelligence and related technologies.

Suppose you want to invest in artificial intelligence. In that case, you need to think carefully about your investment goals, market research, financial statement analysis, macroeconomic trends, risk tolerance, and how you want to spread out your portfolio.

Alternative ways to invest in AI include investing in ETFs, mutual funds, hedge funds, and individual stocks of AI-related companies.

Notable companies that investors can consider when investing in AI include Alphabet Inc., NVIDIA Corporation, Amazon.com, Inc., Microsoft Corporation, OpenAI, and Tesla, Inc.

Investing in AI can be a long-term investment opportunity as the technology has the potential to disrupt various industries, generate high returns, and create new job opportunities. AI can also improve efficiency, productivity, and innovation in many areas, which can help the economy grow in the long run.

Do you want to read more? Check out these articles.